Mirror, mirror on the wall, who’s got the best marketplace of them all?

According to recent statistics published by Tabb Group, that honor goes largely to the group of four traditional pro rata options exchanges. On average, they bested their newer, time-priority rivals in four categories that purport to measure market quality.

The common thread, industry executives tell Traders Magazine, is the fact that all four of the pro rata exchanges operate payment-for-order-flow (PFOF) schemes. Because the market makers on these exchanges are, indirectly, paying retail brokerages for their orders, they have an incentive to quote large size at tight spreads. That way, when the orders come streaming in, they are more likely to interact with them.

“Market makers make their living off of retail flow,” explained Brian Donnelly, chief executive of market-making firm Volant Trading. “So they have a big incentive to quote tight markets on those exchanges where they interact with that flow, which, because of preferencing, tends to be directed to the pro rata exchanges.”

Tabb publishes an “Options Liquidity Matrix” every month, detailing the market shares and execution quality of the industry’s 10 exchanges. The data comes from Hanweck Associates, a vendor of data and risk analytics software.

The four pro rata exchanges the matrix covers are the Chicago Board Options Exchange, NYSE Amex, Nasdaq OMX PHLX and the International Securities Exchange. The six time-priority exchanges covered are the Nasdaq Options Market, BATS Options Exchange, BOX, Nasdaq OMX BX, NYSE Arca and C2, also operated by the Chicago Board Options Exchange.

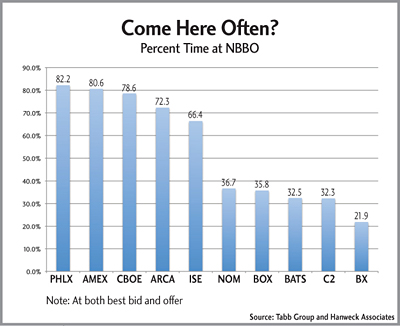

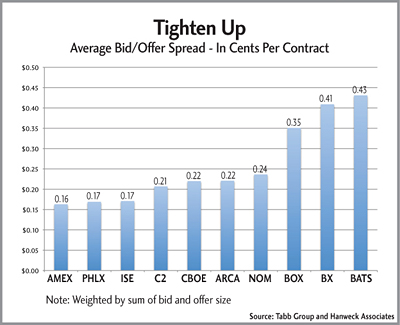

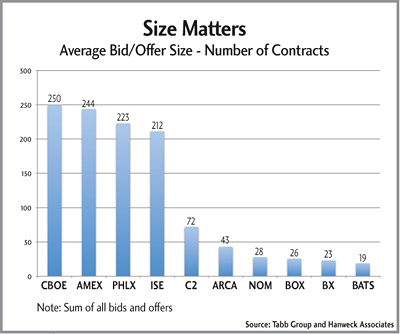

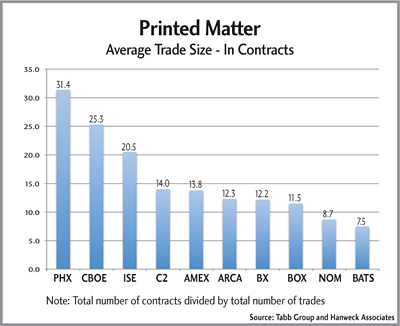

Key market-quality statistics include the average bid-ask spread; the percentage of time the exchange is at both the best bid and offer; the average quoted size; and the average trade size.

In general, the pro rata exchanges, which allocate incoming orders to liquidity suppliers based on the size of their quotes, best the time-priority exchanges, which allocate incoming orders to liquidity suppliers based on their rank in the queue, in all four categories.

In October, the pro rata exchanges had the tightest spreads. They spent the most time at the inside quote. They quoted the most size. They reported the largest trades. Exchange operators and other industry players offered various reasons for the stark differences among the two exchange groups. The most consistent explanation was that the practice of paying for flow wedded the large market makers to the pro rata exchanges.

Despite the fact that they receive rebates when they quote on the time-priority exchanges and pay a fee when they trade on the pro rata exchanges, according to the data, the dealers did their best work for the exchanges that let them pay for desirable retail flow.

“In options, the liquidity providers don’t care about the rebates,” said Rob Newhouse, chief executive of options analytics vendor Viktor Technologies, and the former head of an institutional options brokerage. “The profitability is built into the customer order.”

The options industry’s time-priority (aka maker-taker) exchanges are modeled after the time-priority exchanges in cash equities. Order allocation is based on rank in the queue. Rebates are paid to liquidity providers. Fees are levied on liquidity takers.

While this model has come to dominate trading in cash equities, its growth has stalled on the options side. Collectively, the six time-priority exchanges control no more than 20 percent of the prints.

“The reason the payment-for-order-flow exchanges are beating out the maker-taker exchanges is because of the customer order flow,” Newhouse said. “All the good flow is being directed to the PFOF exchanges because it is being paid for.”

Another trading executive points out that the very nature of the pro rata allocation model encourages the order gathering affiliates of the big market makers to route the orders to the pro rata exchanges.

“They have an incentive to send orders to a place where there are rules that guarantee the market maker will get a certain percent of the flow,” explained Danon Robinson, founding partner at market makers Toro Trading. “So even if I’m at the same price on a maker-taker exchange, I’m not going to get as much order flow.”

Jeromee Johnson, chief executive of BATS Options, acknowledged that market makers have an incentive to quote better markets on PFOF exchanges, but also pointed out that those exchanges also have more stringent market-maker requirements. Chief among them is that dealers must maintain minimum spreads. That is not the case on maker-taker exchanges, Johnson explained.

Traders Magazine contacted all the exchange operators to ask them specific questions about certain of their statistics.

Some of their answers follow.

Spreads

BOX has relatively wide spreads, said Patty Schuler, in charge of sales and marketing the exchange, due to its taker-maker pricing model whereby liquidity providers must pay to quote. The BOX model encourages brokers to send retail orders into its price-improvement auction, she explained.

Jeromee Johnson, BATS Options Exchange chief executive, questioned the methodology used to determine the spread numbers. He argued that BATS’s spreads in high-volume options were on a par with the pro rata exchanges.

Quoted Size

At least one options executive pointed out that the relatively larger quoted size on the pro rata exchanges might not be comparable to that on the time-priority exchanges. Traders must quote in larger size if they are to trade at all, because they must share the execution with another trader, the executive noted.

Executed Size

Dividend trades, whereby market makers may trade up to 250,000 contracts, probably skew the data higher at certain exchanges, some executives said. Nasdaq OMX PHLX is the biggest exchange operator to allow market makers to capture dividends on unexercised options contracts. Also, those pro rata exchanges offering multi-leg trades via complex order books will show bigger prints. The trades are typically done by institutional investors.

In contrast to its pro rata peers, prints on Amex are small. According to Steve Crutchfield, NYSE Euronext’s head of U.S. options, that’s because Amex is “very friendly to retail participants.” Amex never charges a fee for retail orders, regardless of the size of the trade, Crutchfield noted.

c) 2012 Traders Magazine and SourceMedia, Inc. All Rights Reserved.

http://www.tradersmagazine.com http://www.sourcemedia.com/