In this research note from Brad Lamensdorf, manager of the actively managed Ranger Equity Bear short-only ETF (HDGE), he forecasted the equity markets will move higher for the remainder of 2018.

Below, he gives his three reasons:

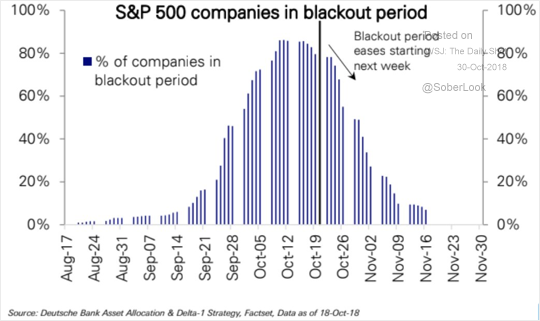

Although important technical and economic factors make us extremely cautious about the equity markets longer term, were looking at three shorter-term indicators that tell us the markets could experience profitable upward bounces during the rest of 2018. For one thing, as illustrated by the chart below, most public companies can once again buy back their own stock after emerging from blackout periods that suspend buybacks before earnings announcements. Indeed, the fact they couldnt buy during September and October may have exacerbated the recent sharp market declines.

Another positive is that the Ned Davis Research short-term sentiment indicator is at only 20% bullish, the lowest level of the year. That means theres a huge amount of bearish sentiment out there. And thats positive news from a contrarian point of view since historically many investors are wrong about market direction, too often buying at highs and selling at lows..

More good news for the remainder of 2018 is that a lot of mutual funds and the like subject to the 1940 investment company are done with the tax selling of the last two months that helped depress the markets. So that adds even more liquidity for upward market momentum this year as these investment companies initiate buying programs to maximize annual returns after flat to downward performance for the first 10 months of the year.

Will share buybacks (after the blackout period) provide some tailwind for stocks?