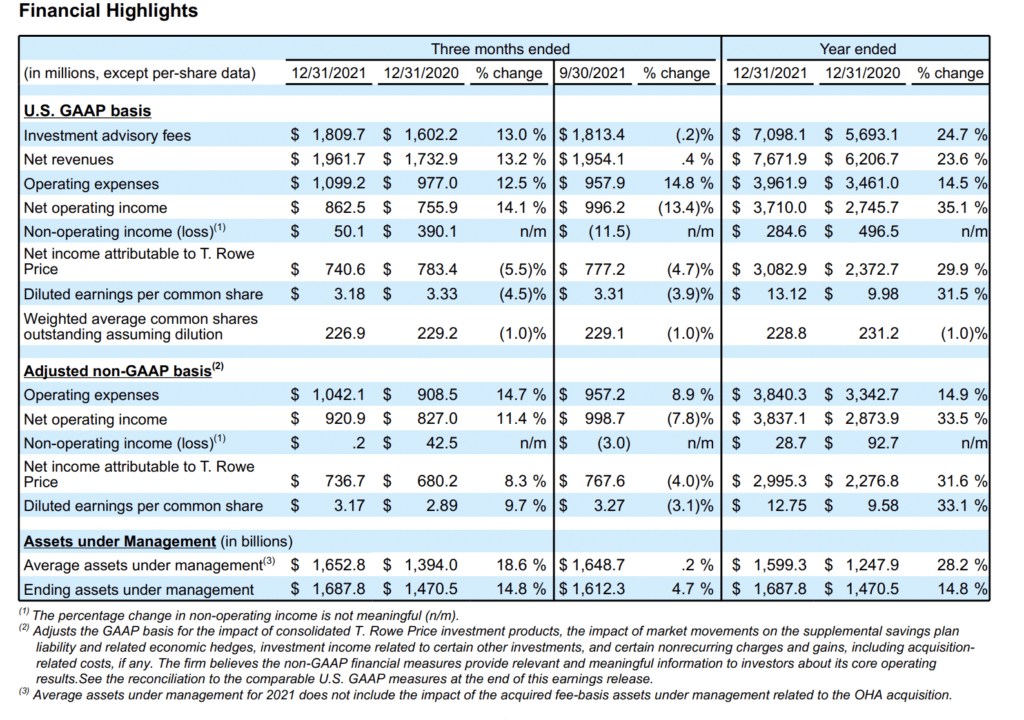

T. Rowe Price Group has reported strong revenue growth of 13.2% for the fourth quarter of 2021 and 23.6% for the year, driven by market appreciation boosting average assets under management.

The asset manager continued to invest in strategic initiatives, but spending lagged revenue growth resulting in record profitability and diluted GAAP EPS of $13.12 and adjusted non-GAAP EPS of $12.75 for the year.

In the fourth quarter T. Rowe Price bought back over 3 million shares, which, combined with prior quarters’ repurchases, regular dividend, and a special dividend earlier in the year, returned $2.8bn to stockholders in 2021.

In addition to capital return, T. Rowe Price used $2.5bn in cash to fund part of the acquisition of OHA, a $57bn alternative credit firm.

“Still, our balance sheet remains strong with over $2bn in cash and discretionary investments at year end,” commented Rob Sharps, CEO and President.

Net revenues earned in Q4 2021 were nearly $2bn, an increase of 13.2% from Q4 2020.

Average assets under management in Q4 2021 were $1.65trn, an increase of 18.6% from Q4 2020.

The firm voluntarily waived money market advisory fees in Q4 2021 of $14.9m to continue to maintain positive yields for investors.

The firm anticipates that the waivers in Q1 2022 will be at a slightly lower level than Q4 2021, and the firm expects to continue to waive fees through at least the first half of 2022.

Operating expenses in Q4 2021 were $1.1bn, an increase of 12.5% compared to Q4 2020.

On a non-GAAP basis, the firm’s operating expenses in Q4 2021 were $1.0 billion, a 14.7% increase over Q4 2020. The firm’s non-GAAP operating expenses exclude the impact of the supplemental savings plan, consolidated sponsored products, and transaction costs incurred related to the acquisition of OHA. The increase in the firm’s non-GAAP operating expenses from Q4 2020 was primarily due to higher compensation costs; higher distribution and servicing costs as average assets under management increased over the prior year; and higher costs for technology development, associate transition, and core operations provided by FIS since August 2021 for the firm’s full-service recordkeeping offering.

The costs incurred from the FIS arrangement were partially offset by a reduction in the compensation expenses as a result of the approximately 800 associates who transitioned to FIS in August 2021.

The firm currently estimates its 2022 non-GAAP operating expenses, including a full-year of OHA’s operating expenses, will grow in the range of 12% to 16%.

Non-operating income was $50.1m in Q4 2021, as compared to non-operating income of $390.1m in Q4 2020.

At the end of 2021, Bill Stromberg retired as CEO after a distinguished 35-year career with the firm.

“Bill successfully led us through a challenging time for our industry. His legacy leaves us well positioned to take advantage of the significant opportunities ahead of us,” Sharps said.

“As we enter 2022, our focus on investment performance and outstanding client service remains our top priority. To deliver on these imperatives, we will continue to draw on our rich history and culture, while adapting to the changing landscape in our industry,” he added.