By Shane Swanson, Senior Analyst, Market Structure and Technology, Greenwich Associates

The equity market, it seems, is again obsessed with dark pools.

Alternative Trading Systems (ATSs) have recently seen investment and purchases at an astounding level.

In just the last few months we have seen the purchase of LiquidNet by TP ICAP, BIDS by Cboe, and a minority investment in Level by Nasdaq. New entrants like PureStream and Blue Ocean have gotten approval and begun trading with potentially differentiating trading strategies.

Clearly, dark pools are hot again.

At the same time, the level of scrutiny over what occurs in the dark has risen steadily. The battle lines drawn back in the Flash Boys days have also become reinforced. At times, the grenades being lobbed into the Twittersphere would have the world believe that sinister forces have taken over and that the end is nigh.

But before we start wearing clapboards around Times Square, it might be an opportune time to sit back, look at some data, and see if the sky is falling or not. (Hint, it’s not).

Marching Forward

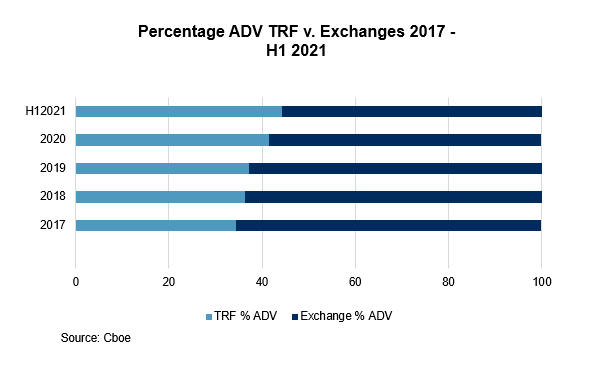

Looking at overall market volumes, it is true that off-exchange trading has grown as a percentage of overall market volume over the past few years. Volume reported to the Trade Reporting Facilities (TRFs) has grown from 34.49% of overall average daily volume (ADV) in 2017 to 44.29% in H1 of 2021. This nearly 10% growth has been fairly steady over the years, although accelerating recently:1

However, the movement of the volume from on-exchange to off-exchange is only the first part of the question. The more interesting question is – Where did it go? Fortunately, there are some pretty clear answers.

Marching in Place

ATSs (Dark Pools) percentage volumes have actually not risen in lockstep with the rest of the TRF’s off-exchange bounty. In the past several years, ATSs’ fortunes have actually seen something of a minor yo-yoing, with their percentage of market share dropping from 13.14% in 2017, to a low point of 8.54% in 2019, but climbing up to 10.64% in 2020 and 9.73% in Q2 of 2021. If ATSs aren’t seeing the volume, who is?

Leaving a Mark

The vast majority of the remainder of trading off-exchange occurs with the market makers. Although there is plenty of debate on the subject (and I mean plenty of debate), we still believe that the market has never been better for retail traders.2 There are, of course, ways that the market can be improved, but retail traders have zero commissions, high levels of price improvement, extremely good trading technology, and generally a better trading experience than any time in history.

All of that said, there are other participants in the off-exchange trading world. There are Single Dealer Platforms (SDPs), bulge bracket banks, and all-in more than 200 firms that printed trades to the TRF in Q2 of 2021. Admittedly, some of those firms only print a few trades to the tape per month (or even only one), perhaps trade corrections or the like. Nonetheless, the fact remains that there is a vibrant community of firms that work in the off-exchange market.

Scouting Ahead

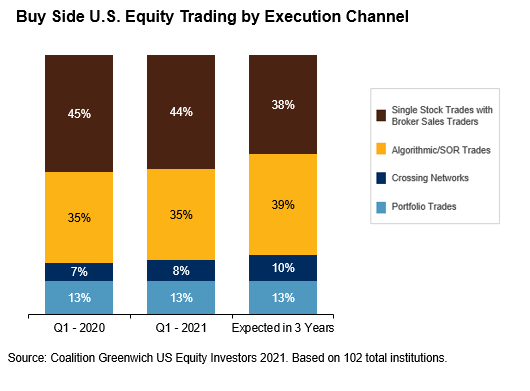

Buy-side institutions have been accessing dark liquidity since…well…forever. Our research shows that their views on accessing crossing networks has remained relatively stable over time. That said, we do see an anticipated increase in usage over the next three years across all sizes of institution participants. We also see a relatively large increase in the use of low touch/algorithmic access.

With this data in front of us, one might well ask why dark pools have again been getting such strong attention. Coalition Greenwich data shows that both BIDS and LiquidNet have always ranked highly on our scale of “uniqueness” for liquidity, and Level has been hitting record volume numbers.3

In each case, these buyers are hoping to gain the precious commodities of additional flow and “synergies”. An increase in low touch and algo trading may forecast an increased appetite for the crossing opportunities that ATSs have in their DNA.4

Whether these maneuvers pay off or not remains to be seen, but in the meantime, it is important to keep a clear head and not fall prey to fanciful memes about the terrors of the dark.

1 Source: Cboe

2 See, for example https://www.greenwich.com/equities/impact-zero-commissions-retail-trading-and-execution

3 https://www.greenwich.com/equities/algos-atss-and-automation-equity-markets

4 Although, to be fair, the same is also true of the exchanges, which, by definition are where buyers and sellers are brought together to execute.

Source: Coalition Greenwich