The reecent open letter from the SEC to investors and platforms that refer to themselves as exchanges is an important step for them to push the crypto markets towards maturation. While stopping short of immediate enforcement actions, it is clear that the SEC is pushing hard towards a more regulated and stable secondary market for trading crypto-assets. As with their recent sweep targeting the primary issuance (ICO) market, I view this as a constructive step, as long as they provide the current dominant platforms both clarity and time to comply.

The reason that I make the point about both clarity and time to comply is that the SECs prime directive is investor protection[1]. If they were, however, to immediately declare that markets such as Gemini, GDAX, Kraken, Bittrex, & others operating in the U.S., had to immediately cease and desist trading of crypto assets, that would cause panic, investor losses and widespread losses. The immediate market reaction to the letter (shown below) shows what could happen, only on a much larger scale. On the other hand, providing such markets with the opportunity (and obligation) to comply with a principles-based regulatory approach would likely increase investor confidence and institutional participation in the market.

(Notice how the market not only fell immediately on the news, but the Consolidated Best Bid and Offer became crossed, with a much higher best bid than the best offer during the volatility. This signals situations where investors cant quickly determine the best price and can result in additional losses.)

I think it is worth stressing the point that a principles-based approach to regulation would be superior with regard to the secondary trading of crypto-assets. The key principles I will articulate below are based on common sense and well-established precedents, but since the technology is new, specific, existing rules often apply poorly. In addition, we should recognize that the crypto markets are global, and there is a risk that over-regulation could well result in U.S. companies losing out on potentially important technology competitiveness. Additionally, there is a risk of shutting out U.S. investors from a dynamic new market, and it is likely that many will attempt to circumvent rules by trading outside of the country, where protections will be much less.

So, what are the key principles that I am suggesting that both the SEC and CFTC stress in their evolving regulation?

- Just and equitable markets

- Best execution

- Know your customer

Lets examine each in turn:

Just and equitable markets: This is the broad umbrella under which regulators have established rules in three main areas: prevention of manipulation, ensuring a level playing field for investors, and encouraging stable and available markets. Manipulation is the bane of price discovery, and the SEC and CFTC have both been active in various enforcement actions in their respective jurisdictions. It is hard to argue that a market that allows spoofing or other activities designed to fool investors into believing false prices is a good thing, yet many crypto markets have little to no oversight to prevent or detect such behaviors. In addition, it is rare to find prohibitions in crypto markets on wash trading, which can create an illusion of liquidity when there is none, or be used to directly manipulate the price of indexes used to settle derivative contracts. It would be a positive development, therefore, for there to be scrutiny of these activities.

The concept of ensuring a level playing field for investors is much more nuanced, but there are some consistent themes. While regulated markets do allow different tiers of service or the ability to restrict access to data, such things are accomplished by pricing tiers, not backroom deals. In the crypto-world, there are no such rules, so exchanges are free to provide different levels of service or access to data to other firms based on their own judgement of whether those firms are good or bad for their business. Imagine a world where the NYSE could legally deny its direct market data to an OMS vendor or a trading firm whose management offended them. Such an abuse of power would not be tolerated, but it could happen today in the crypto world. I am not alleging that it has happened, but I have been made aware of the fact that it could occur.

The notion of encouraging stable and available markets is the rationale behind Regulation SCI, which recently made headlines when the NYSE was fined $14 million for various violations on August 24, 2015. Without going into the details, it is readily apparent that there are no such rules in the crypto markets for exchanges to comply with those rules, and exchanges are free to make their own decisions regarding availability. While I am not suggesting that the crypto exchanges have done anything wrong in particular, the concept of being made accountable for disrupting the market would make sense. For example, in the equity markets, the introduction of Limit Up, Limit Down rules has provided some needed help for maintaining orderly markets. There is no such concept in crypto markets, despite the fact that those markets would undeniably benefit.

Best execution: This is the principal that states that brokers or markets will take all reasonable steps to ensure that client orders they receive get executed at the best possible price based on the circumstances and instructions for that order. While It is impossible to define rules with complete precision, as there is tremendous variation between orders and market conditions, there are some basic precepts that can be utilized by regulators. Notably:

All markups and fees should be fully disclosed

Prices should not be made in a vacuum; other markets prices should be taken into account

Reporting that compares execution to prevailing prices should be available on request

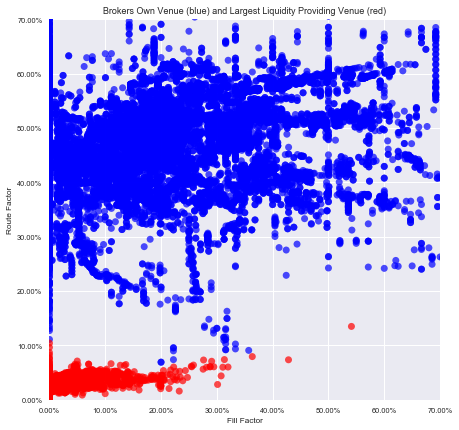

As I have previously written, this is not the case at the moment in crypto. Even for Bitcoin, the most liquid instrument, there is confusion over the prevailing price at particular moments in time. That is why we created both our Consolidated BBO product and our RealPrice. The CBBO we have built allows investors to see the same displayed prices from individual exchanges on an aggregated basis, while the RealPrice is a transparently created price that measures the actual cost of trading key quantities of crypto assets. It takes all exchange bids and offers into account, as long as those exchanges accept local clients and freely allow local currency withdrawals and deposits. The combination of these products would enable any exchange or broker the ability to comply with the principles of best execution as I have defined them.

Know your customer: This category includes the often repeated KYC / AML stipulations that many crypto investors hear about with regard to ICOs. What it means, however, is that broker dealers or markets should understand both suitability of products and / or that solicitation or advice provided is suitable to clients. It also imposes an obligation to both report suspicious client activity to the regulators and ensure compliance with money laundering rules.

In addition to this, in the crypto world, there are companies offering ranges of products and services that go beyond what traditional securities firms offer. For example, there is one firm offering index products, exchange services, account management, and online trading and mobile applications akin to retail stock broker platforms. Such vertical integration is not necessarily a bad thing, but the obligations with regard to clients should certainly be evaluated.

In conclusion, I remain hopeful that the SEC and CFTC will navigate a path towards such a principles based regulatory regime. The letter that triggered todays reaction seems to be carefully worded, and is likely a reaction to market participants paying lip service to the notion of complying with basic rules. If this nudge from the SEC helps the current platforms accelerate their efforts to register in the US and signal a willingness for the SEC to work with those markets, it would be a major positive step. If, however, that is not the case, it could be a rough time ahead for those of us who believe that crypto-assets are a major part of our future.

[1] For fellow Star Trek fans, the SECs Prime Directive, unlike the United Federation of Planets, is not a prohibition to interfere in the cultural development of a planet

David Weisberger is Co-Founder and CEO of Coinroutes LLC