A few months back, Bitwise released a 104-page white paper. which discussed, among others, the manipulation of crypto-markets.

In the document, the authors use different methods to analyze and point out the current inconsistencies linked with trading data.

One of their points of focus – Reported vs. Actual trading volume of different cryptocurrency exchanges.

Their findings were at least surprising, if not shocking, for the crypto community. We have compiled an infographic to help you understand the results of their research:

Why are exchanges reporting fake volumes?

The paper further delves into the reasons which lead cryptocurrency trading platforms to manipulate the data presented on their website. These reasons are summarized as follows:

Popular exchanges get more media attention – In order to increase their popularity and attract new users, cryptocurrency exchanges present inflated numbers. This helps them rank on top of CoinMarketCap’s Exchange listing (by reported trading volume). As a result, they are seen as authoritative platforms and receive more media attention.

Higher listing fees from ICOs, IEOs, and Altcoins – Top-list exchanges can attract much higher listing fees from cryptocurrencies that wish to be listed on their platform. Higher volume means more trading. And by more people trading a certain coin, higher liquidity is achieved.

Combating fake volumes in cryptocurrency markets

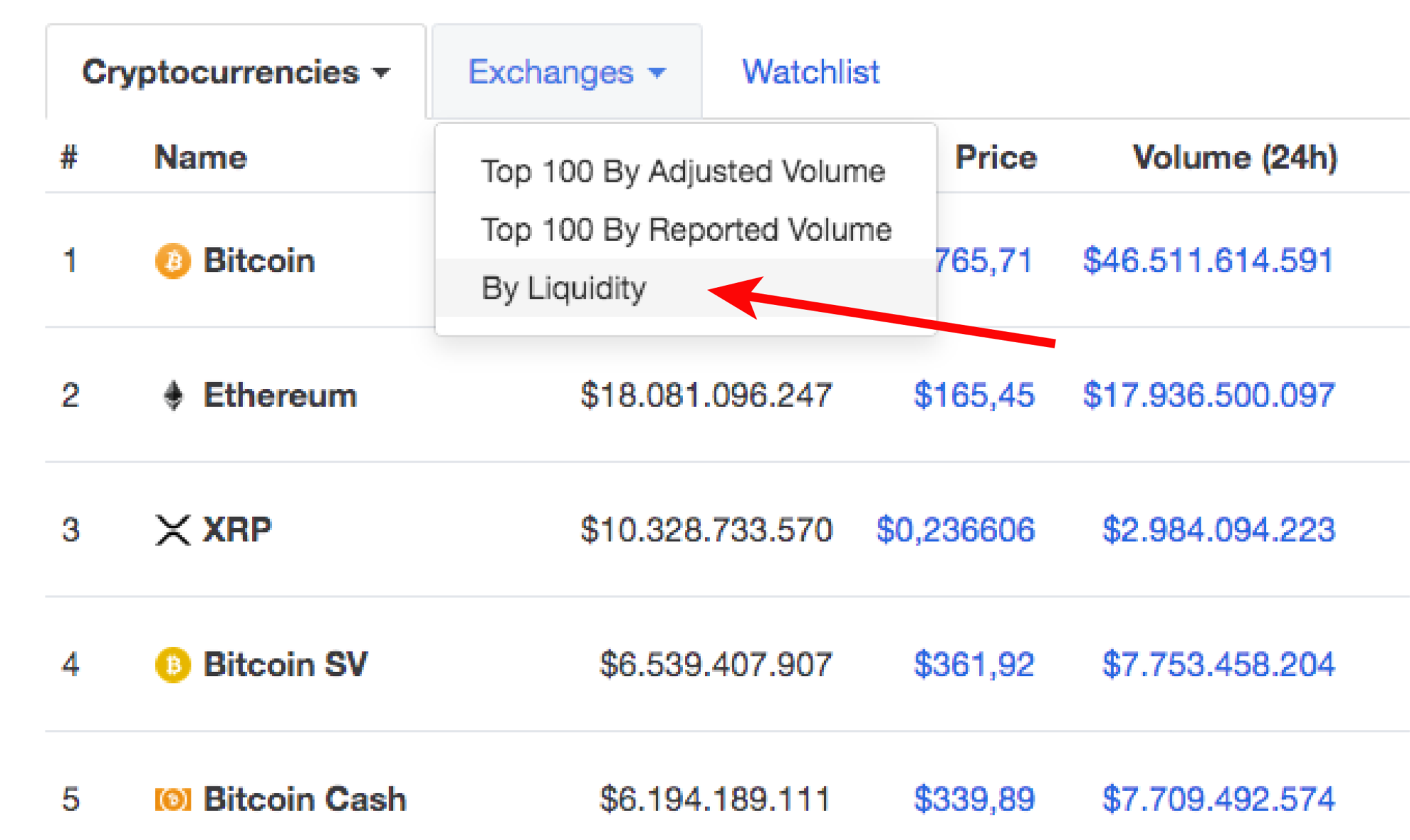

CoinMarketCap, a well-known website that tracks the activity of more than 5000 cryptocurrencies and exchanges, recently added a new metric.

The liquidity metric, which was added in November of 2019, will allow users to compare different platforms based on their liquidity.

This metric comes long after CMC’s Chief Strategy Officer Carylyne Chan announced that they would look into the information of Bitwise and improve the transparency of the market.

Filtering exchanges based on their liquidity is meant to “clean up” the misinformation spread by unethical cryptocurrency platforms.

You can easily check the position of your favorite platform by clicking on Exchanges and selecting By Liquidity.

No matter how we look at it, the discovery of Bitwise will eventually improve the reliability and transparency of cryptocurrency exchanges.

Regulations in the crypto-market

Six of the ten platforms that were found to present real trading volumes are based in the US.

Additionally, when looking at the same pool, the only platform that is not considered to be a money service business (MSB) is Binance.

Finally, it’s important to mention that all US-based cryptocurrency exchanges possess a BitLicense.

This document ensures the legitimate operation of these services and is issued by the New York State Department of Financial Services.

As you can tell by now, regulatory oversight is more present than initially thought. As such, users can rest assured that the ten exchanges shown in the study are fully transparent and safe to use.

The crypto market has matured

A little more than two years have passed since Bitcoin’s last All-time high.

It was during that time that Bitcoin gained mainstream media attention, growing from $1000 to almost $20000 in a market labeled as the “wild wild West”.

But since 2018, the crypto market seems to be more “tamed” and mature. Consumers are still fairly hesitant to invest.

After all, not many of us could handle another drop to $3200.

Yet, big institutions, governments, and countries are more involved than ever, trying to find ways to utilize the blockchain and create state-backed currencies.

Bitwise confirms this statement as well. The white paper suggests that the Bitcoin market is now more mature than ever.

The deviation of Bitcoin’s price in the top 10 exchanges is constantly decreasing. This also decreases arbitrage trading opportunities which, overall, creates a more stable market.

What to expect

Fake volumes in cryptocurrency markets are still an issue.

However, as time goes on, Bitcoin gains more authority as a currency and a long-term investment.

Small and irrelevant cryptocurrencies will eventually perish. Scammy exchanges will be deemed irrelevant, as most investors will focus on transparent cryptocurrency platforms.

Websites like CoinMarketCap will develop better volume metrics and popular exchanges will grow substantially.

While exchange platforms and Bitcoin are still in their early stage of development, we have already seen a lot of progress towards a more honest and regulated market. And we believe that this trend won’t slow down any time soon.