Access to banking and access to credit are the most significant infrastructure gaps in the bitcoin market according to institutional market participants.

The Bitcoin Trading Ecosystem, a survey by Arcane Research and LMAX Digital, found that access to banking was the biggest infrastructure gap highlighted by brokers while proprietary trading firms and high-frequency traders said access to credit was a big gap.

Arcane Research is a part of Arcane Crypto and provides data-driven analysis and research for cryptocurrencies. LMAX Digital is an institutional spot cryptocurrency exchange run by the LMAX Group, which also operates trading venues for foreign exchange, metals and indices which are regulated by the UK Financial Conduct Authority.

The study said: “Notably, corporates see a lack of global regulation as a major concern.”

This year has been marked by speedy institutional adoption of bitcoin.

“From billionaire hedge fund managers such as Paul Tudor Jones, to U.S. banks given the green light to hold customers’ digital assets, a remarkable shift in attitudes towards cryptocurrencies is evident,” said the report. “The recent increase in institutional demand highlights the growing legitimation of bitcoin as an asset class.”

Institutional investors can in invest in bitcoin in spot markets such as LMAX Digital, via derivatives such as CME Group’s bitcoin futures; and through investment vehicles like Grayscale’s Bitcoin Trust, which have all increased in popularity over the last year.

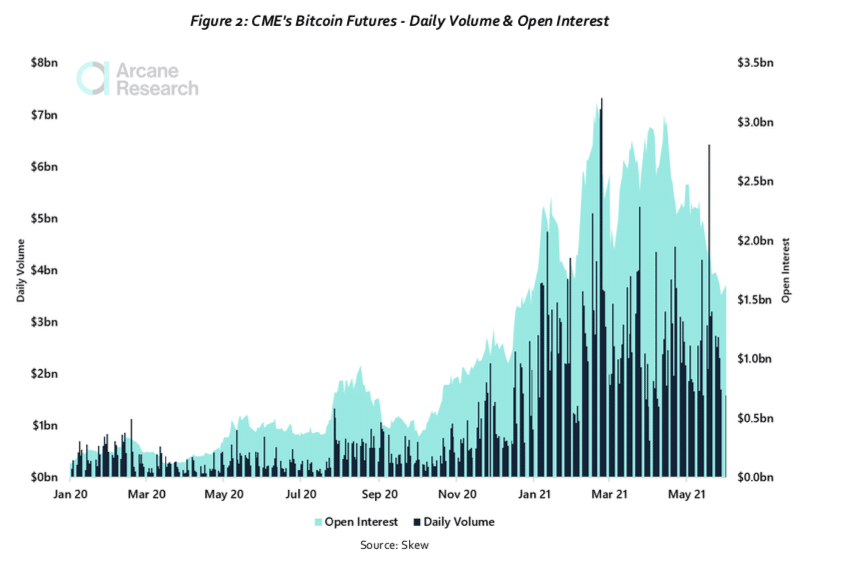

LMAX Digital only provides access to institutions and argued that its trading volumes are therefore a proxy for institutional interest. The exchange had an average daily trading volume of $2.4bn (€2bn) in bitcoin in May and reached record volumes. In addition the average daily volume of CME bitcoin futures was more than $2.6bn in the same month.

“Moreover, from the beginning of 2020, the open interest increased from around $200m to above $3bn, before decreasing to around $1.5bn again with the latest market correction, said the report. “These contracts are only available for institutional investors and show the explosive demand for bitcoin exposure from this investor group.”

CME said the volume of Micro Bitcoin futures passed 1 million contracts on June 25 this year.

Brooks Dudley, global head of digital assets at ED&F Man Capital Markets, said in a statement: “This is a tremendous achievement for a contract that was just launched seven weeks ago. We’ve seen more institutional volume than we anticipated, which shows that the timing was right for a smaller bitcoin contract.”

Custody

Custody of bitcoin has been a barrier for institutions who want digital asset custody to be as robust as for traditional assets. However, traditional custodians such as BNY Mellon and Northern Trust have announced they will be offering custody for digital assets.

“Moreover, Fidelity has already built a bitcoin custody service for its institutional clients,” said the report. “These traditional firms are joining several crypto native custody providers, such as Coinbase, Gemini, and BitGo. The dominos are falling fast.”

In addition TP ICAP said this month it is launching a wholesale trading platform for cryptoassets in collaboration with Fidelity Digital Assets, Zodia Custody and Flow Traders, subject to registration with the UK Financial Conduct Authority.

Simon Forster, co-head of digital assets at TP ICAP, told Markets Media at the time: “I can’t stress enough that TP ICAP is doing this as a long-term play as we believe this is a secular shift like electronification 20 years ago.”

Forster continued that electronification was a huge infrastructure upgrade in bringing liquidity to trading screens in the front office. In a similar fashion, blockchain-based assets require an upgrade in infrastructure for post-trade settlement and clearing.

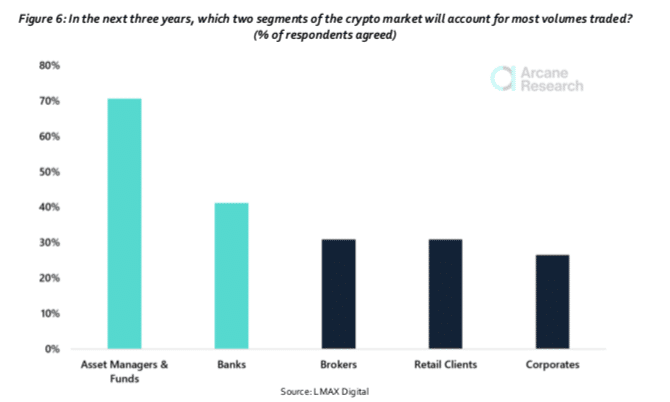

Asset managers, funds, and banks are expected to be the most significant contributors to bitcoin trading volume in the next three years according to the study.

The survey continued that recent developments in the ecosystem will lead to the asset class to maturing. Regulators will increase venue requirements to protect retail consumers and will also contribute to making bitcoin an asset well suited for institutional investors.

“Over time, we believe that the increased institutional presence will lead to a more substantial part of the price discovery in bitcoin to occur on regulated institutional trading venues,” concluded the study.