This article first published as Beyond Liquidity on Markets Media. Beyond Liquidity, produced in partnership with Liquidnet, is a weekly content series that addresses challenges in trading equities, bonds and listed derivatives.

Global listed derivative volumes are expected to remain strong in 2023 after reaching a record last year, according to data tracked by Liquidnet.

2022 global listed derivatives volumes (excluding single stock options) reached 71.1 billion contracts, an increase of 47.7% from the previous year according to Liquidnet’s 2022 Listed Derivatives Review. However, options trading on Indian indices accounted for 20.2 billion contracts of growth, almost all of the global increase of 22.5 billion contracts exchanged globally last year. Removing India from the data reduces total global growth to 7%.

Mike du Plessis, global head of listed derivatives at Liquidnet, said: “Last year was a huge year for macro – big, liquid instruments put in big performances after a long period of low interest rates, flat curves and low volatility. Equities, particularly tech, had effectively become an expression of the quest for duration, so saw a significant turnaround with the shift in the rates regime – it changed everything.”

He expects this year to be interesting because the rates market is currently discounting the end of the cycle in an environment of ongoing high geo-political uncertainty. Historically these types of shock led to emergency stimulus but with the inflation fall-out, central banks have been forced to apply the brakes – engaging in a balancing act with high risks associated with a misstep.

“The market is looking around two corners with the shape of the curve expressing quite a precise view on a forward basis, but it is very rare that the market gets this exactly right,” du Plessis added. “As a result, we are going to course correct and see some very strong bursts of activity in the year ahead.”

Futures volumes and options volumes behaved differently in 2022. Global futures volumes, ex-India, fell 4.2% while, in contrast, options volumes rose 29.3% from the previous year.

Futures prices are a direct representation of the underlying assets; volume growth was constrained as volatility increased. As asset prices increased traders could achieve the equivalent economic exposure using fewer futures contracts. For example, 2022 was a banner year for commodities markets. The volume of ICE Endex Dutch TTF Natural Gas futures fell 5.3% year-on-year. However, Liquidnet’s analysis found that the US dollar value of those contracts grew by approximately 150% over the same time period and the contract entered the Top 50 in the firm’s global ranking for the first time.

In contrast to futures, options prices are a function of volatility and allow investors to obtain an economic exposure, while knowing their maximum loss. Global options volumes are dominated by the US where SPY Options reached a record 1.82 billion contracts traded and the volume of QQQ ETF Options almost doubled to a record 662 million contracts year-on-year.

“Whilst out-performance by ETF options points to the ongoing robustness of retail activity in 2022, additional evidence also can be gleaned from the continued success of the CME’s micro futures contracts,” added Liquidnet.

Fixed income

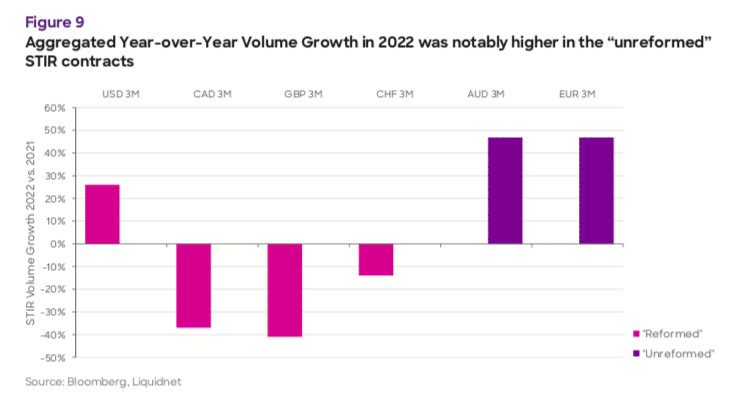

The developed market central bank hiking cycle set the stage for a stellar 2022 for short-term interest rate (STIR) contracts globally where futures and options volumes increased 24.7% to 2.41 billion contracts.

Last year the CME 3-Month SOFR contract rose to become the largest futures contract in the world by US dollar notional in the Liquidnet global rankings. However, Liquidnet noted that volume in the ICE Financials Euribor futures grew 51.4% to an all-time record of 282.7 million and the Euribor options market volume also jumped 570% year-over-year.

After the financial crisis in 2008 there were a series of events regarding banks manipulating their submissions for setting Libor benchmarks, which led to a lack of confidence and threatened participation in the related markets. As a result, regulators have increased their supervision of benchmarks and moved to risk-free reference rates (RFRs) based on transactions, so they are harder to manipulate and more representative of the market and the US regulators chose SOFR (Secured Overnight Financing Rate).

Du Plessis said: “The only thing you really needed to trade last year to express what was in effect a singular global theme was SOFR. Whilst it did well, I was actually surprised that it didn’t do even better. It was interesting that as rate markets lit up, RFR-linked contracts were significantly outperformed by contracts that referenced credit sensitive, term benchmarks ”

He highlighted that with reduced “utility”, the RFR-linked STIR contracts might be seeing a reduction in real world utilisation for hedging, suggesting this might hurt volumes once central bank activity subsides and their speculative and pure rate hedging value declines.

“The RFR-linked futures market may see some impact such that volumes become more periodic. We have seen this for years in the CME Group’s Fed Funds Futures market which can move from super active to near-dormant and back again with the ebb and flow of Fed cycles” said du Plessis.

Liquidnet has been writing about the impact of the LIBOR transition on liquidity and the execution process from its early stages. Du Plessis said: “The research process is important to us; we want to make sure that our execution tools and algorithms are designed in such a way that they adapt seamlessly in response to changing liquidity states so that our members can transition rapidly between electronic and voice-supported execution in an intelligent way.”

Exchanges

Three derivatives exchanges, CME Group, ICE and Deutsche Börse’s Eurex dominate listed derivatives volumes. Du Plessis said: “It was a year for big exchanges with big products.”

The trio’s contracts took 36 of the top 50 places in Liquidnet’s global rankings and 89% of the traded notional in the top 50. The report said: “Liquidnet estimates that, at approximately $906 trillion, 81.5% of the entire value of global exchanged US dollar notional equivalent in 2022 was concentrated into these three exchange groups.”

Du Plessis expects exchanges to continue to try to bring retail liquidity, particularly in equities, onto their venues in a quest for growth and liquidity consolidation. For example, in January 2023 CME announced an expansion of its suite of weekly options expiries for its Micro E-mini Nasdaq-100 and S&P 500 futures, pending regulatory review. Micro E-mini Equity Index futures and options have become among the most actively traded equity index products at CME Group, achieving a combined record volume increase in 2022 of more than 50% year-over-year.

“A benefit of bringing retail into the exchanges’ liquidity pool is that large asset managers can access it with a reduced level of intermediation versus the more traditional routes by which this retail component eventually finds its way back to the larger sized index futures contracts,” added du Plessis.

In commodities markets the Shanghai International Energy Exchange’s Crude Oil futures had volume growth of 25.6% in 2022 – notable because it is an institutionally sized, Yuan denominated, physically delivered oil contract.

Liquidnet said: ““These volumes equated to an 85% jump in the USD equivalent notional value exchanged, boosting the contract 18 places in our global rankings estimate—sufficient to give the benchmark Chinese Crude Futures contract a first Top 50 appearance. This achievement is all the more remarkable given that the Shanghai Crude contract was only launched in April 2018.”

Crypto

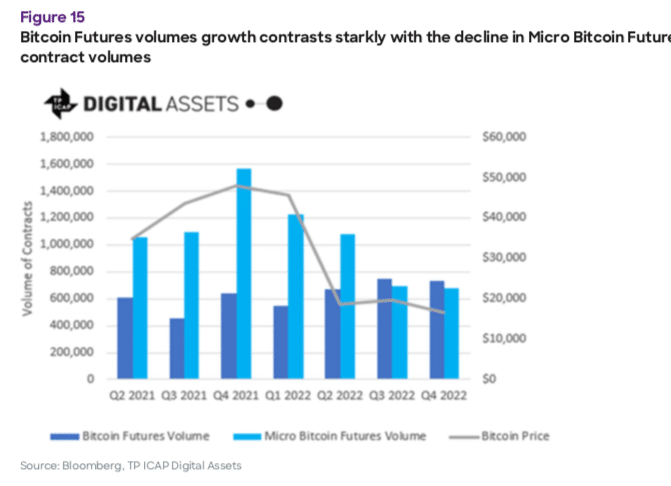

Another potential growth area is institutional activity in crypto markets, despite the bankruptcy filing of crypto exchange FTX. Liquidnet pointed to prospects for the “benchmark” CME Bitcoin Futures Contract, and the exchange reported that average daily volume for its cryptocurrency contracts rose 82% in 2022.

TP ICAP Digital Assets highlighted important features of the contract which point to its growth prospects amongst institutions; an ongoing decline in volatility, continued growth in Bitcoin futures volumes, faster growth than the retail-sized CME Micro Bitcoin Futures and the increasing proportion of volume transacted using exchange blocks.

“The irony that what is sometimes described as trust-less money became victim of miss-placed trust in the form of FTX has not been lost on institutional clients” said du Plessis. “I think we are going to see a more simple approach which involves going through known and trusted intermediaries.”

He continued that most large institutions are in the process of building, or have already built, the ability to trade crypto, not least because it represents a real world sandbox for the acquisition of institutional knowledge in the managing of the fundamental components of a digital asset. Learning how to buy, sell, store, lend, secure, transmit, hedge, leverage, risk manage, compliance monitor and financially account for a ledger based asset will prove a critical exercise.

Environmental, social and governance (ESG) contracts have been promoted as another potential growth area but in 2022 ESG index futures volumes had lower growth than broader indices at just 4.8%.

“Screening methodologies in ESG came under some scrutiny in the news through the course of 2022 and may not be quite right at this stage meaning growth appeared lacklustre last year,” du Plessis said. “From an overall volume perspective, ESG is still very small indeed.”

Liquidnet’s latest Listed Derivatives report can be read here.