Harmonizing Through Orchestration: How Capital Markets Firms Can Capitalize On Digital Transformation for Success

By George Black, Capco

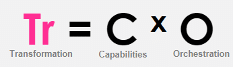

Orchestration is critical to maximizing the value of your digital transformation

It seems that every new piece of technology investment is branded as advancing a firm’s “digital transformation” goals, yet the end results often feel less than transformational. New technologies and platforms do not inherently unlock value for an enterprise, rather it is how these platforms are utilized by the organization to achieve goals that dictates whether an investment fulfills its business case. Digitally-enabled transformation is as much a function of a firm’s capabilities, as it is their ability to orchestrate those capabilities across client and enterprise touchpoints in a consistent and effective manner.

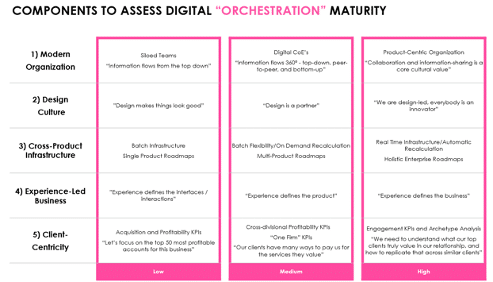

Key dimensions of Digital Orchestration Maturity

Whether it is sales and trading automation or risk modernization, the goal of any digital transformation at a capital markets firm is to capitalize on its resources, maximize ROI, and elevate the firm to the status of a market leader.

- Modern Organization – Information should be shared throughout the organization with the goal of breaking down siloes and creating a collaborative culture across different departments front-to-back along the value train. In the current remote, hybrid, and distributed workforce environment, firms must focus on equipping staff with the right tools to collaborate (e.g. JIRA, Symphony), creating groups/mediums open across different businesses and product organizations, and enabling cross-sharing of transformation ideas. Financial institutions should embrace a ‘fail fast, fail often, and fail forward’ mantra that is key to any digital transformation. By aiming to create solutions in short, sprint-like cycles, financial institutions establish the foundation for creating a culture of rapid execution that can significantly improve a firm’s transformation timeline. Finally, being modern in the digital transformation context is about creating a meritocratic dialogue between the front, middle, and back offices, as well as technology and support functions.

- Design Culture – Capital markets firms must embrace creative thinking to equip employees from many industries with innovation skills to co-create and spark innovation across functions. Connecting multiple different product teams and businesses, Citi’s D10X innovation lab has acted as a hot “design” bed for new ideas, especially by uniting different businesses to co-create enterprise solutions for better client and end-user outcomes. One of its outputs is an amalgamation of client experience and computer programming – the Inquiry Engine, a machine learning and natural language processing-powered system that answers client questions automatically. It is a perfect example of how different businesses can co-create and break down cultural and logistical challenges to generate and execute a new idea to reveal a hidden value within client organisations.

- Cross-Product Infrastructure – The vast array of capabilities expected of a modern capital markets firm paired with an ever-changing regulatory landscape creates an elaborate challenge. Firms cannot look at roadmaps on a single product level but must adjust and create enterprise-level roadmaps. Consider a combination of internal and external pressures affecting capital markets firms today. On one hand, Basel IV and the IRB Repair Package regulations are mandating firms to implement a holistic, enterprise-level risk and capital management practices. On the other hand, firms are internally pressured to provide scalability and analytics capabilities to manage capital and balance sheet real-time irrespective of highly fragmented operating models and legacy data/IT architecture. As one of the antidotes, the push for the cloud-based infrastructure addresses this complex, multi-layered requirement, and enforces the ‘orchestration’ thinking. Considering all the risks (e.g., information security, data privacy) and benefits, as well as ensuring highly collaborative and orchestrated transformation efforts, the dynamic cloud infrastructure can drastically increase agility and scalability across an enterprise while reducing integration barriers and costs.

- Experience-Led Business – These are businesses and enterprise capabilities aligned and structured to the client/user experiences. While experience traditionally defined client/end-user interfaces or products at best, leading capital markets firms ensure that experience defines its entire business. Consider prime brokerage – some capital markets firms have traditionally focused its digital transformation efforts on specific services offered to hedge funds (e.g., trade capture, asset servicing, regulatory reporting). However, market-leading firms focus on building an entire experience through a platform of experiences – be it access to specific data, competitive pricing, funding, exchange connectivity or real-time risk reporting. By focusing its entire business around experiences, a firm can ensure its digital transformation efforts are aligned across and maximize differentiated value for clients and end-users.

- Client-Centricity – Enforcing a better understanding of your client and continuously delivering more value for clients. Enter client-centric analytics: use data to gain visibility into client acquisition cost and the lifetime value of current partnerships. Data-driven insights into client behaviour facilitate marketing to, benchmarking, and acquiring new clients. Realized benefits include more accurate client segmentation, deeper awareness of client profitability, and cross-selling opportunities. In one example, JP Morgan launched a proprietary customer relationship management (CRM) and sales and trading analytics platform where the system mines corporate and institutional client data and its previous trades and behaviour, helping the salesperson suggest trades best suited to the client.

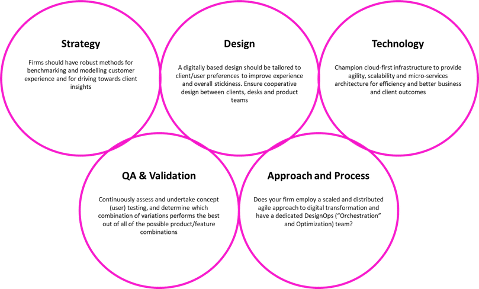

Measuring your firm’s capabilities maturity

While orchestration takes the main part of the argument for a truly enabled digital transformation, the importance of capabilities cannot be ignored. Capabilities maturity refers to a firm’s ability to evolve and provide a differentiated service to its clients. Capability maturity signifies the players and tools of the sports team. For “players” in capital markets, this refers to the technologies, tools, and modern skills the firm deploys to provide value to their clients. There are five key pillars that underpin mature capabilities – strategy, design, technology, QA & validation, and approach/process – all of which reinforce the need for firms to employ structure and enterprise-wide standards in digital transformation of capabilities.

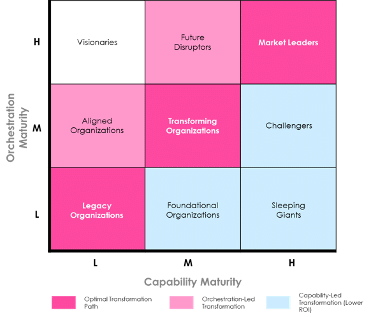

Where are you in your orchestration and capabilities maturity journey?

Firms that do not foster a collaborative environment for ideas and information to flow freely across teams can find themselves trapped as “sleeping giants” or “foundational organizations.” Meanwhile, “market leaders” combine the best of both in digital transformation – continuously improving its capabilities, as well as building a meticulous orchestration environment at all levels and functions of the organization.

George Black is partner and US head of the capital markets domain at Capco, a global technology and management consultancy and can be reached at George.Black@capco.com.

References

- https://www.capco.com/Intelligence/Capco-Intelligence/How-Can-Digital-Help-Realize-Value-In-Capital-Markets?utm_campaign=Global+2021+Cap+Markets+&utm_content=&utm_medium=social&utm_source=linkedin

- https://www.cnbc.com/2020/10/27/jpmorgan-creates-new-unit-for-blockchain-projects-as-it-says-the-technology-is-close-to-making-money.html

- https://www.ft.com/content/1eaf6436-e4a2-11e6-9645-c9357a75844a

- 791748788.1539313599&_gac=1.192587480.1577886797.CjwKCAiAo7HwBRBKEiwAvC_Q8bfJIe1EG3cnFQhCmv5X3cC1llb1B1T_V7rYsEr1bwkAUySqCWu75RoCAXIQAvD_BwE

- https://www.cbinsights.com/research/report/finance-corporate-innovation-labs/