Talos, an institutional technology provider for digital asset trading, has raised $40m (€33m) while State Street has launched a new division for digital finance.

In May 2021 Talos announced the completion of a $40m Series A investment round led by venture capital firm Andreessen Horowitz. Other investors included PayPal Ventures, Fidelity Investments, Galaxy Digital, Elefund, Illuminate Financial, and STEADFAST Capital Ventures.

The firm was founded in 2018 by Anton Katz, chief executive, and Ethan Feldman, chief technology officer, and publicly announced its platform in October last year.

Katz told Markets Media: “The goal for us is to create a service that institutions can use to interact with digital assets by providing an envelope of services.”

Feldman added that Talos has, from the beginning, focussed on supporting the full trade lifecycle including liquidity sourcing, direct market access, price discovery, algorithmic trade execution, transaction cost analysis, reporting, clearing, and settlement.

“The really big players are not just concerned about trade execution but also settlement,” said Feldman. “They want to use a single platform to complete the settlement and that is built into crypto.”

Talos also connects market participants including institutional investors, prime brokers, exchanges, OTC desks, lenders, and custodians through a single point of entry which can be adapted to their individual investment or workflow requirements.

Chris Dixon, general partner Andreessen Horowitz, and Arianna Simpson, partner at the venture capital firm, said in a blog that they were looking to invest in a company that would help bridge the gap between traditional finance and the crypto ecosystem.

“Building a robust infrastructure stack that could connect dozens of liquidity sources and eventually support trillions of dollars in traded volume would be no small feat,” they wrote.

They also invested in Talos because Katz and Feldman spent six years working together at Broadway Technologies building financial infrastructure for traditional markets, which is relevant experience for expanding Talos.

“Today, Talos powers a wide range of institutions that interact with digital assets – from hedge funds trading cryptocurrencies through the Talos UIs and APIs to asset managers and brokers providing crypto trading services to their clients through Talos’s Dealer offering,” wrote Dixon and Simpson.

Feldman continued that institutions usually enter the crypto market through one broker but as they become more sophisticated, they want more liquidity providers.

“Using Talos gives them access to that one broker but also many others through one access point,” Feldman said. “They can also get access to exchanges.”

Clients can also access other service providers in the ecosystem such as custodians or lenders.

Katz continued that Talos provides real-time TCA. At the end of each month Talos provides aggregated anonymous reporting of pricing in its liquidity pool to clients and dealers.

“We are making the market very transparent for liquidity providers and our customers,” he added. “The technology is embedded in this asset class to do things that are not being done in capital markets. We want to build a better financial infrastructure to help the market evolve.”

Growth

Dixon and Simpson believe there will a “massive influx” of institutional capital into crypto in the next few years.

Katz said institutional adoption of crypto assets has accelerated dramatically. “Comparing 2018 to 2021 or 2020 is like night and day,” he added.

He continued that the fundraising will be used to expand Talos’ liquidity pool and to grow internationally.

“We have a really strong client base in United States but the involvement of institutions with digital assets is global,” Katz added. “We already have clients outside the US and this investment will expand that footprint in regions such as Asia Pacific and then Latin America.”

Katz said Talos has a large pipeline of clients to onboard and will also be introducing new functionality and better connectivity between asset classes, including with the foreign exchange market. As a result Talos will be recruiting in order to scale and meet demand.

DeFi

Katz continued that many institutions are asking how they connect to the decentralized finance, or DeFi sector. DeFi, or Open Finance uses smart contacts automatically executing on distributed ledger technologies, such as blockchains, to allow any user to stake cryptocurrency as collateral on a platform and provide services such as lending or liquidity without the involvement of a traditional financial intermediary.

“The plan for Talos has always been to bring traditional assets into the crypto infrastructure,” he added. “We want to make sure when that happens, we are there and we hope to be the driver allowing institutions to trade everything through one platform.”

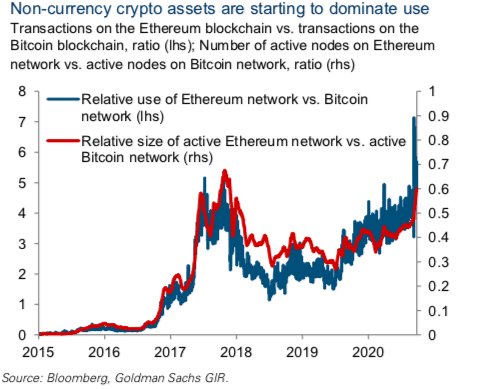

Jeff Currie, global head of commodities research at Goldman Sachs, said in a report that cryptos are a new class of asset that derive their value from the information being verified and the size and growth of their networks.

In the Goldman study, Crypto: A New Asset Class ?, Currie argued that since information on a blockchain is immutable, it cannot be changed without consensus, and trusted information can then be tokenized and traded. As a result, a blockchain platform like Ethereum could potentially become a large market for vendors of trusted information, like Amazon is for consumer goods today.

“In our view, the most valuable crypto assets will be those that help verify the most critical information in the economy,” he said. “Over time, the decentralized nature of the network will diminish concerns about storing personal data on the blockchain.”

Currie continued that many overvalued networks exist but a few will likely emerge as long-term winners in the next stage of the digital economy although there are technological, environmental and legal challenges.

“If crypto assets are to survive and grow to their fullest potential, they need to define some concept of “sufficiently decentralized” that will satisfy regulators; otherwise, the technologies will soon run out of uses,” he added.

Michael Sonnenshein, chief executive of Grayscale Investments, said in the Goldman report: “As investors have seen the advent of new use cases on top of blockchains like Ethereum, whether that be the proliferation of DeFi, non-fungible tokens (NFTs), etc., they have increasingly moved beyond just allocating to bitcoin and instead are seeking exposure to the entire ecosystem.”

State Street

In another indicator of increased convergence, State Street is launching a division for digital finance which will include crypto, central bank digital currency, blockchain, and tokenization.

State Street Digital, will be led by Nadine Chakar, previously executive vice president and head of State Street Global Markets. She will report to Lou Maiuri, chief operating officer of State Street Corporation.

Ron O’Hanley, chairman and chief executive officer of State Street Corporation, said in a statement: “Digital assets are quickly becoming integrated into the existing framework of financial services, and it is critical we have the tools in place to provide our clients with solutions for both their traditional investment needs as well as their increased digital needs.”

The firm said its proprietary GlobalLink technology platform will be enhanced into a digital multi-asset platform.

Chakar said in a statement: “We have been developing a number of digital capabilities and other solutions as well as partnering and investing in the infrastructure that forms the foundation of State Street Digital. As digital currencies and tokenization not only gain momentum, but transform financial infrastructure and operating models, we can help our clients bridge the gap between the industry of today and the one of tomorrow.”

Tony Bisegna, global head of portfolio solutions, FX sales and trading, and research for State Street Global Markets, replace Chakar as head of Global Markets effective September 1, 2021.