HFT is Dead. Long Live HFT.

Traders Magazine Online News, January 8, 2018

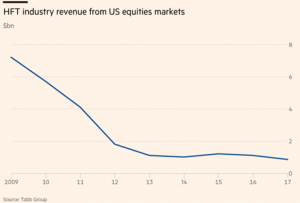

The FT has just published an interesting piece titled “How High Frequency Trading Hit A Speed Bump” . While the main point of the piece was to highlight a new high speed transatlantic route known as “Go West”, the piece feels more like a HFT post-mortem. Comments from HFT folks about how profits have decreased due to higher data costs and lower volatility are frequent in the piece. The FT also published the below graph from the Tabb Group about decreasing HFT profits:

The commoditization of speed is also another main point in the piece. One HFT executive is quoted as saying “We don’t necessarily value absolute speed as much as relative speed.” The article implies that speed is no longer the determining factor in HFT.

Average readers may come away from reading this piece and think that HFT is dead but regular readers of the Themis Trading blog know that this is not true. In fact, our friends at IEX just published a piece titled “Incentivizing Trading Behavior Through Market Design” which takes a very close look at the speed games that are still going on in the equity market.

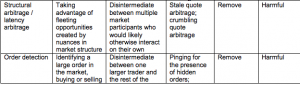

IEX breaks down various proprietary trading strategies and notes that there are some beneficial market making strategies, but there are also HFT strategies which are still harmful to the market. Two of these harmful strategies are Structural Arbitrage (aka Latency Arbitrage) and Order Detection:

IEX notes that these strategies are currently legal and IEX doesn’t think that is the problem. Rather, they blame our conflicted market structure for giving these traders the tools to execute their harmful behavior. According to IEX:

“Our position is that it would be impractical and ill-advised for regulators to attempt to outlaw even the trading strategies that we consider to be net harmful. We live in a capitalist society, and the typical operators of these strategies are not customer-facing and thus have no fiduciary obligations. We believe there are conflicts of interest in the markets that sometimes enhance these opportunities, and those conflicts should be eliminated.”

IEX particularly singles out their exchange competitors as the source of the problem:

“Unfortunately, there is not much a broker can do to avoid structural arbitrage, as these opportunities exist within the fabric of stock trading infrastructure. We believe that only the exchange operators are in a position to realistically make a dent in preventing these scenarios, although they are by no means typically economically incentivized to do so.”

We agree with IEX and believe that the recent US Court of Appeals ruling in the City of Providence, et al. v. BATS Global Markets, Inc. case could possibly convince the exchanges that they need to change their practices. The court ruled that “exchanges are not entitled to absolute immunity” which opens the door for numerous class action lawsuits filed by investors against the exchanges to proceed and could result in millions of dollars in damages against the stock exchanges.

For more information on related topics, visit the following channels:

Group Co.

Group Co.

Comments (0)